"You can skip spending $5 at Starbucks every day and save $10,000 over the next 5 years, but if you think $10,000 is going to change your life, you're not just broke, you're being stupid." - Grant Cardone

A hardnosed, in depth, and realistic look into the intricacies of success.

Friday, December 7, 2018

Winning or Losing by Saving???

A few weeks ago, I came across this Instagram post from CNBC on a Grant Cardone quote.

Tuesday, December 4, 2018

FIRE(D)!!!

FIRE(D) - Financial Independence Retire Early (by Default???). So, I had planned on being out of the corporate workforce within two years to concentrate on my investments, property, and businesses. Well, that plan was just accelerated after I was let go from my position this past Friday, 11/30/2018, due to downsizing. So now, Decision Day approaches. Now, the fun begins . . .

Monday, November 19, 2018

Well, that was a quick 2.5 years . . .

After a 2.5 year hiatus - and I'm not really sure if that was intentional or not - I decided it was time to post an update. Wow, a lot has happened with a few trips around the sun! Looking through past posts, I have mixed feelings. I can honestly say I'm proud of how much I've stayed the course, even without writing this blog to help keep me in line. However, I also remember why I think I stopped writing for a while. I think I wanted more out of my writing and I gave up trying to get there. That lack of fulfillment came maybe as I ran low on interesting material that I was passionate about writing or maybe as I felt my time was better spent on productive activities such as reading or researching ideas, rather than writing about dreams. Anyhow, I guess I got the bug again . . .

Tuesday, November 24, 2015

Streamline Your Mind

From successful businessmen to politicians and entrepreneurs to investors, a penchant for reading seems to be a common trait existent in many of the world's top leaders. From President Obama to former NFL quarterback Fran Tarkenton, many start their days scouring the local and national newspapers and favorite blogs.

"The Week" published a wonderful article in 2013 describing Warren Buffett's and Charlie Munger's reading habits. Here's an excerpt:

"The Week" published a wonderful article in 2013 describing Warren Buffett's and Charlie Munger's reading habits. Here's an excerpt:

Warren Buffett says, "I just sit in my office and read all day."

What does that mean? He estimates that he spends 80 percent of his working day reading and thinking.

"You could hardly find a partnership in which two people settle on reading more hours of the day than in ours," Charlie Munger commented.

When asked how to get smarter, Buffett once held up stacks of paper and said he "read 500 pages like this every day. That's how knowledge builds up, like compound interest."The article goes on to describe how possible Buffett successor, Todd Combs, has heeded his bosses advice and reads up to a thousand pages on some days!

Monday, November 2, 2015

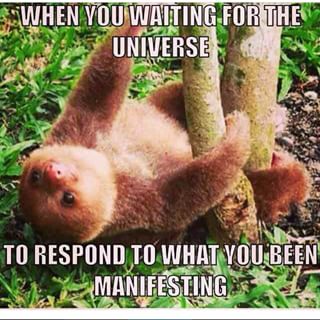

"Waiting for the Universe to Respond to What You've Been Manifesting"

Over the weekend, I stumbled upon this picture on Instagram:

It was so ridiculous and pointless - just like most brain-drain social media posts, I suppose - but it was also one of those images that became stuck in my head. How often do you feel like this? I mean, REALLY feel like this? I've felt this way more lately than I can ever remember - and it's tough. Anxiety has got to be one of the most difficult emotions to suppress. If you're like me - and I'm assuming if you're reading this then we likely share number of similar characteristics - it is not in your nature to sit back and watch the world go by. You need to be doing something; you need to be planting some seed or nurturing one that you've previously sown. Sitting and watching is next to impossible.

Labels:

achievement,

American Dream,

deliberate practice,

discipline,

dream,

early retirement,

goal,

goals,

hotshots,

inspiration,

Inspirational,

practice makes perfect,

productivity,

progress,

Shark Tank,

success,

talent

Friday, October 16, 2015

Investing in Others' Dreams

I recently have had the opportunity to invest in a small startup restaurant in my home town, the owner being a high school friend/acquaintance from years ago. He is only looking for a little startup capital - rent and labor in our town is so cheap; the downtown building he wants to lease/purchase will cost something like $700/month and it is in the heart of our town of 20,000 people. Our downtown used to be more vibrant. Or, at least, that's how I remember it growing up. We have an old courthouse in the center of town that gives the town character and a welcoming feel, our Fourth of July parade is packed every year, we have nice clean lakes that are great for boating and fishing, and the downtown area has potential if the right people were involved. The compassionate, nostalgic part of me wants to give him his money and hope he succeeds. The logical, business side of me says, "Restaurants fail. Bad investment" - even if it is a relatively small sum.

Friday, October 9, 2015

Entity and Incremental Learning

|

| From Business Insider |

While her book was a great read, I had forgotten - or, more likely, didn't yet understand - how enlightening her concepts really were. That was until a couple of months ago. Not only did her writing continue to pop up in a number of books I had been reading, but my son was born. After seeing how fast little babies pick up new habits and how quickly they learn, I began to think about the best way to raise him from a psychological standpoint to empower him to live the best life he possibly can. I remembered Dweck and gave myself a refresher of her teachings, which took on an entirely different meaning than the first time I plowed through "Mindset".

One of the tenets of "Mindset" was the distinction between entity and incremental learning. Entity learning was the belief that brainpower and intelligence were innate and could not be improved. It gave the individual a sense of entitlement. On the opposite end of the spectrum was incremental learning: the belief that "the novice can become the master" (quoted from "The Art of Learning"). Empowering!

Labels:

achievement,

American Dream,

deliberate learning,

deliberate practice,

discipline,

dream,

early retirement,

goal,

goals,

income growth,

inspiration,

Inspirational,

laziness,

progress,

talent

Monday, August 31, 2015

The Opportunity Cost of Fantasy Football

I have recently been the recipient of verbal office jabs for my choice to abstain from Fantasy Football this year. My retort? The opportunity cost of drafting, managing, and discussing Fantasy Football does not warrant participation. I played last year. I enjoyed it. I enjoyed it a little too much, spending Sunday's refreshing my phone at the local B-Dubs, telling my wife I need some obscure receiver to catch at least 4 passes for me to lock in a playoff spot - as if to include her in my predicament. The end of the season was a welcome relief, maybe as much for me as it was for her. No matter how many times I have vowed to not let FF take over my life, I still found myself sucked into the office banter throughout the week and a zombie - a shell of my non-football self - on Sundays. I am STILL being sucked into the office conversations, and I'm not even playing this year! That's power of Fantasy Football!

What is the tradeoff for that time and stress? What am I missing out on? Am I getting more out of participating than I would from some other activity? What are the opportunity costs?

What is the tradeoff for that time and stress? What am I missing out on? Am I getting more out of participating than I would from some other activity? What are the opportunity costs?

Sunday, August 23, 2015

Like Diamonds, Cycles are Forever - Premature Thoughts on a Stock Market Crash

It is a bit early to call this past week's action a "crash" or to state that the market is in the midst of a crash, but it is also always wise to plan ahead for various possible future scenarios. From a value investor's standpoint, crash = opportunity. The last few years since the 2009 financial crisis, may have been a bit rough for value investors. While the rising tide of the market over the last 6 years has inevitably raised all boats, those who focus solely on a Graham-esque value strategy may have been left in the dust as growth stocks have been the been doing the heavy lifting.

Bull runs of this nature are difficult for a value investor to stomach. He likely invested in the 2009 crash, enjoyed the gains until he sold out at what seemed a fair valuation, and subsequently watched agitatingly while the overall market continued to appreciate. He has likely either converted to mostly cash or focused on commodities, energy, and possibly retail stocks, which have lagged behind the rest of the market sporting low P/E's and P/B's. Energy and commodities, specifically, have been absolutely hammered this year, while the Dow finally appears to be leveling off after the 5 year bull run. He follows all of the rules he has picked up from Graham, Buffett, and gang, yet it appears those around him blindly throwing money at in-vogue stocks like Tesla are the ones celebrating! He has flashbacks to 1999-2001.

But bull markets must come to an end and, like diamonds, cycles are forever. Love him or hate him (I, for one, am not a big fan), Jim Cramer makes some valid points in "Real Money" when it comes to cycles.

Bull runs of this nature are difficult for a value investor to stomach. He likely invested in the 2009 crash, enjoyed the gains until he sold out at what seemed a fair valuation, and subsequently watched agitatingly while the overall market continued to appreciate. He has likely either converted to mostly cash or focused on commodities, energy, and possibly retail stocks, which have lagged behind the rest of the market sporting low P/E's and P/B's. Energy and commodities, specifically, have been absolutely hammered this year, while the Dow finally appears to be leveling off after the 5 year bull run. He follows all of the rules he has picked up from Graham, Buffett, and gang, yet it appears those around him blindly throwing money at in-vogue stocks like Tesla are the ones celebrating! He has flashbacks to 1999-2001.

But bull markets must come to an end and, like diamonds, cycles are forever. Love him or hate him (I, for one, am not a big fan), Jim Cramer makes some valid points in "Real Money" when it comes to cycles.

Labels:

Ben Graham,

cycles,

early retirement,

financial freedom,

income growth,

investing,

p/b,

price to book ratio,

price to earnings,

progress,

stocks,

success,

trader,

value investing,

Walter Schloss,

Warren Buffett

Thursday, August 20, 2015

Lessons of an Investing Addict Part 2: Book Value Strategies

“I’m not very good at judging people. So I found that it was much better to look at the figures rather than people. I didn’t go to many meetings unless they were relatively nearby. I like the idea of company-paid dividends, because I think it makes management a little more aware of stockholders, but we didn’t really talk about it, because we were small. I think if you were big, if you were a Fidelity, you wanted to go out and talk to management. They’d listen to you. I think it’s really easier to use numbers when you’re small.” -- Walter Schloss

In Part 1 of this series, I talked in generalities about laying the groundwork for becoming a successful investor. I discussed some good literature to get you started down the right path and suggested familiarizing yourself with economic cycles. Finally, you should choose whether you identify yourself as a speculator, a trader, or an investor and then to get your feet wet by putting a minimal amount of funds into a discount brokerage to get a "feel" for the market.

I have spent years researching different methods of equity investing and learned some expensive, but valuable lessons along the way. My ego has led me to believe I could trade stocks and beat the market; convincing me that somehow I had the gift to outdo the money managers who live and breath this stuff all day, every day. I have since moved on from the guessing game and built an investment strategy around the techniques of Graham, Buffett, and my favorite, Walter Schloss.

If you have any doubts about the effectiveness of a long-term value-investing approach, I highly encourage you to read "The Superinvestors of Graham-and-Doddsville", a speech by Buffett to a class at Columbia. Buffett does a fantastic job articulating the school of thought that these "Superinvestors" adhere to while dispelling the argument that randomness is solely responsible for an investor's success.

In Part 1 of this series, I talked in generalities about laying the groundwork for becoming a successful investor. I discussed some good literature to get you started down the right path and suggested familiarizing yourself with economic cycles. Finally, you should choose whether you identify yourself as a speculator, a trader, or an investor and then to get your feet wet by putting a minimal amount of funds into a discount brokerage to get a "feel" for the market.

I have spent years researching different methods of equity investing and learned some expensive, but valuable lessons along the way. My ego has led me to believe I could trade stocks and beat the market; convincing me that somehow I had the gift to outdo the money managers who live and breath this stuff all day, every day. I have since moved on from the guessing game and built an investment strategy around the techniques of Graham, Buffett, and my favorite, Walter Schloss.

If you have any doubts about the effectiveness of a long-term value-investing approach, I highly encourage you to read "The Superinvestors of Graham-and-Doddsville", a speech by Buffett to a class at Columbia. Buffett does a fantastic job articulating the school of thought that these "Superinvestors" adhere to while dispelling the argument that randomness is solely responsible for an investor's success.

Monday, August 17, 2015

You Win! Now What???

"If you don't continually revise your goals, the only place you've got to go is down." - Laird Hamilton, World Renowned Surfer

I've written extensively about the process of goal setting and listed some literature that expounds on those ideas (e.g. "Think and Grow Rich", "The Art of Learning", and "Mindset" - take a look at the "Good Reading" page for additional suggestions). However, what happens when a goal is within site or attained? What do we do next? How often do you see professionals who seem to mentally "check out".

The first one that comes to mind (as football season is drawing near!) is (former) NFL quarterback Jake Locker.

I've written extensively about the process of goal setting and listed some literature that expounds on those ideas (e.g. "Think and Grow Rich", "The Art of Learning", and "Mindset" - take a look at the "Good Reading" page for additional suggestions). However, what happens when a goal is within site or attained? What do we do next? How often do you see professionals who seem to mentally "check out".

The first one that comes to mind (as football season is drawing near!) is (former) NFL quarterback Jake Locker.

Wednesday, August 5, 2015

Lessons of an Investing Addict Part 1: The Groundwork of an Investor

I've discussed in previous posts that keeping a tight budget is very important in reaching your financial goals. A Google search will turn up hundreds of articles providing ideas on how to trim your budget and an entire blog community exists full of participants trying to outdo one another on who can live in the most frugal manner. I think that is a little extreme.

Instead, I want income growth to be the main driver of my financial independence. I tend to focus much of my free time and energy on stock investments and I will outline my strategy here. Disclaimer: I also mentioned in a previous post that I don't necessarily agree with Jim Cramer's overall investment philosophy, but from his book "Real Money", I wholeheartedly agree with his concept of dedicating a minimum of 1 hour per week per stock to research.

Instead, I want income growth to be the main driver of my financial independence. I tend to focus much of my free time and energy on stock investments and I will outline my strategy here. Disclaimer: I also mentioned in a previous post that I don't necessarily agree with Jim Cramer's overall investment philosophy, but from his book "Real Money", I wholeheartedly agree with his concept of dedicating a minimum of 1 hour per week per stock to research.

Tuesday, August 4, 2015

Financial Freedom - July 2015

I recently (better late than never!) came across a couple of blogs that I really enjoyed on personal finance: Root of Good and Mr. Money Mustache. Both blogs focus on early retirement and different techniques to become financially independent - my goal numero uno. Mr. Money Mustache has a way of conveying to readers the proper mindset one needs to go down this path and the differences between those who achieve this goal and those who do not. My favorite part of Root of Good is the financial update and transparency he provides into his family's financials with monthly updates.

After being inspired by these two blogs of men who have successfully obtained financial freedom, it occurred to me that, while it is extremely beneficial to read about the reflections of those who have succeeded, it may be even more beneficial to document the journey as it unfolds.

After being inspired by these two blogs of men who have successfully obtained financial freedom, it occurred to me that, while it is extremely beneficial to read about the reflections of those who have succeeded, it may be even more beneficial to document the journey as it unfolds.

Labels:

achievement,

American Dream,

deliberate practice,

discipline,

dream,

early retirement,

financial freedom,

goals,

inspiration,

laziness,

lazy,

life,

passion,

productivity,

progress,

strive,

success,

talent

Subscribe to:

Posts (Atom)